- Cost-sharing for Medicare is headed greater for 2021, including Components A and B premiums and deductibles.

- While average premiums are down for both Benefit Plans and Part D prescription drug strategies, other aspects connected to them might cost you more.

- If you struggle to pay for protection, there might be methods to cut your share of those expenses.

As happens every time the calendar turns to a new year, Medicare cost adjustments are about to take result.

This normally implies paying more for some parts of your protection, effective Jan. 1.

For Medicare’s 63 million recipients– many of whom are 65 or older– certain expenses change year to year and can impact premiums, deductibles, and other cost-sharing. While the upward modifications don’t always include huge dollar quantities, they can accumulate.

“Though the boosts are little, we do see retired people stress over them,” said Danielle Roberts, co-founder of insurance coverage company Boomer Benefits. “For folks residing on just Social Security, increases of even simply a few dollars are a concern.”

Basic Medicare consists of Part A (healthcare facility protection) and Part B (outpatient care). About 40% of recipients pick to get those benefits delivered through Advantage Plans, which are provided by private insurance providers. Many of those strategies likewise consist of Part D prescription drug protection and additionals such as dental or vision.

Other recipients stick with standard Medicare and pair it with a standalone Part D prescription drug strategy. Some also buy a supplement plan– aka Medigap — which chooses up some expenses in fundamental Medicare, such as coinsurance or copays.

Here are 2024 expenses, also some ideas for lowering your expense.

Parts A and B

Many Medicare beneficiaries pay no premium for Part A since they (or their partner) have enough of a work history– at least 10 years– of paying into the program through payroll taxes to get approved for it premium-free.

If you don’t fulfill the minimum requirement, however, monthly premiums for 2021 could be as much as $471 a month, depending on whether you’ve paid any taxes into the Medicare system at all. That maximum is up from $458 in 2020.

Likewise for Part A, if you have no additional protection– 6.1 million beneficiaries did not, at last count — you’d pay a $1,484 Part A deductible if you’re confessed to the healthcare facility in 2021 (up from $1,408 this year).

That deductible would cover the very first 60 days per advantage duration. Beyond that, daily copays of $371 (up from $352) apply through the 90th day. Anything above dips from “lifetime reserve” days at a day-to-day rate of $742 (up from $704).

The standard Part B premium for 2021 is $148.50, up from $144.60. The 2021 Part B deductible is $203, compared to $198 this year.

Once you meet that deductible, you usually pay 20% of covered services. Remember that recipients in Benefit Strategies might pay a various quantity through copays, and Medigap policies either totally or partly cover that coinsurance.

If you have a hard time paying for coverage, you may qualify for a Medicare Savings Program, which is administered through state Medicaid workplaces and are generally available to recipients with low earnings.

There are a number of versions of the program, each of which depends at least partially on your income. The choices likewise feature limitations on your offered resources (i.e., cost savings).

Depending on which program you qualify for, your Part B premiums might be paid, in addition to other out-of-pocket expenses such as deductibles, coinsurance, and copayments.

Higher earnings, extra charge

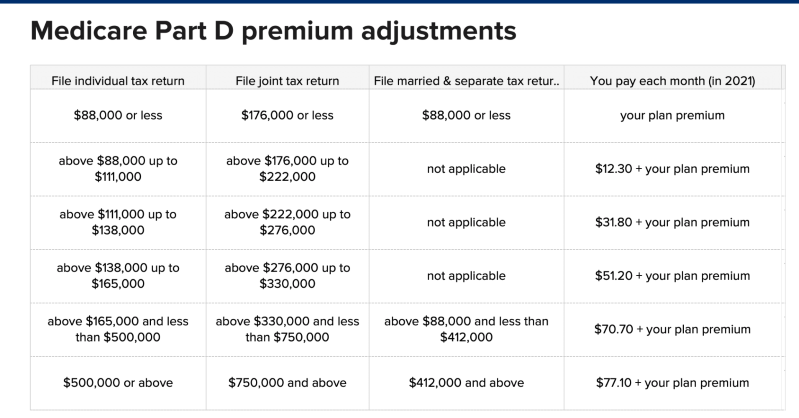

If your modified adjusted gross earnings surpass $88,000 ($ 176,000 for couples), based on your latest income tax return, you will pay more for Components B and D premiums in 2024 due to a so-called income-related month-to-month modification quantity, or IRMAA. These income limits compare to 2023 amounts of $87,000 for individuals and $174,000 for married couples.

For Part B, this suggests paying out anywhere from $207.90 month-to-month to $504.90 in 2021 premiums. For Part D prescription drug coverage, the additional quantities vary from $12.30 to $77.10. That’s on top of any premium you pay, whether through a standalone strategy (whose premiums vary) or through a Benefit Strategy.

If your newest income tax return– probably 2019– does not show an earnings drop this year and you’re scheduled to pay IRMAAs, you can ask the Social Security Administration to reassess, said Elizabeth Gavino, founder of Lewin & & Gavino and an independent broker and basic agent for Medicare plans.

“I have a customer who was at the base level but simply got stuck with a big IRMAA since her 2019 earnings were substantial,” Gavino said. “She’s enticing due to the fact that now she has no earnings can be found in.”

Occasions that certify as justification for minimizing or eliminating the IRMAAs include marital relationship, death of a spouse, divorce, loss of pension, or the reality that you quit working or decreased your hours.

You’ll likewise require to provide supporting documents to justify your appeal. Suitable evidence might consist of a letter from your former company (if you’re no longer working) or something comparable that shows evidence of decreased earnings. There’s a kind you can submit or you can call the Social Security Administration for aid.

Part D costs and help

Premiums for Part D prescription drug plans vary. The average for 2021 has moved to $30.50 from about $32.50 this year, according to the Centers for Medicare and Medicaid Services. However, if there’s a deductible with your protection, it can be approximately $445 for 2021 (a boost from $435 this year).

For individuals with high drug costs, be conscious the amount that Part D enrollees pay of pocket before qualifying for “devastating coverage” is $6,550, up from $6,350 in 2020. Because of the phase of coverage, your share of prescription expenses drops considerably.

Bear in mind that there is no out-of-pocket optimum for Part D protection, whether you have a standalone plan or get advantages through a Benefit Strategy.

If you meet particular income and resource limits, you might receive additional help paying for premiums, deductibles, and copays or coinsurance related to prescription costs. If you receive a Medicare Cost savings Program, getting support for Part D coverage is generally automated.

There are other methods to conserve, too. You can utilize generics when possible to help lower expenses or inspect to see if your state has a pharmaceutical help program that’s readily available to Medicare beneficiaries, Gavino said.

Benefit Strategy costs

While some Advantage Plans come with no month-to-month premium, the 2024 average is an approximated $21, down from just under $24 in 2023, according to Medicare authorities. In either case, you must still pay your Part B premium– although depending on where you live, you may find an Advantage Strategy that offers a partial or full rebate of that monthly charge, said Roberts at Boomer Benefits.

Unlike standard Medicare, Benefit Plans feature annual out-of-pocket optimums.

For 2021, that amount can be as high as $7,550 (up from $6,700 this year) for in-network protection prior to the plan pays 100% of covered services (omitting your prescription drug costs, which do not count towards that cap). The combined in- and out-of-network maximum for 2021 are $11,300.

Generally speaking, the lower the premium, the more you’ll pay in cost-sharing, specialists state. And the specifics of that– whether out-of-pocket limitation, deductibles, copays, or coinsurance– vary from strategy to strategy.